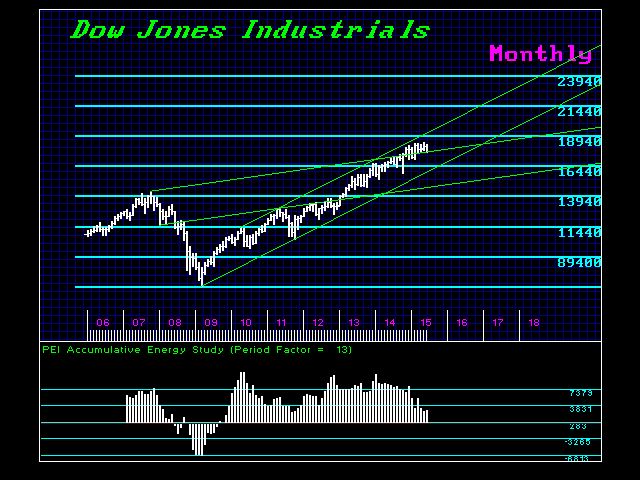

We have a Daily Bullish Reversal in the Dow at 18105.00. A closing above that will warn of a retest of the May high of 18421.13. We still do not see a major crash unfolding and the next three months will remain choppy.

We have a serious risk of two patterns. Do we get the correction into the ECM, or do we get an initial high with the ECM? The first would be the more normal pattern. However, we do not live in normal times. If we penetrate the May high, expect a rally into the ECM with the traditional crash. The talking heads will proclaim their infallibility once again. But such a pattern would more likely that not be short-lived and then blast to a new high, a Phase Transition will most likely follow.

Keep in mind either way we must get that False Move, which sends the majority to one side and creates the energy like a pendulum to rapidly swinging back in the opposite direction. We are not swinging to new highs in a dramatic fashion, so this does not appear to be the False Move taking the market to new highs for a major crash. That would be more akin to a doubling in the price within the last year, which has not taken place. Therefore, the steady hold of higher price levels implies the False Move will be to the downside and not the upside.

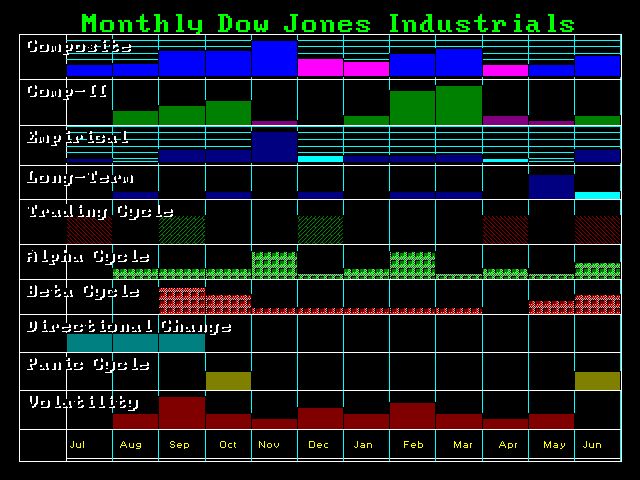

Now you can see why we made the World Economic Conference AFTER the ECM for this will be the beginning of a move – not the end.