QUESTION: Why do nearly 40% of billionaires drop out of school? It seems like the most successful people are all dropouts. Would you explain why?

- Bill Gates

- Steve Jobs

- Mark Zuckerberg

- Rush Limbaugh

- Ralph Lauren

- Steve Madden

- Rachael Ray

- Coco Chanel

ANSWER: Very simple. Formal education is incapable of teaching creativity. This is why there is the old saying, “A students work for C students, and B students work for the government.” Formal education is merely the way we perpetuate mistakes from one generation to another. Even Albert Einstein ended up with an HONORARY degree in science. Albert was trained as a teacher in physics and mathematics. In 1901, he gained his diploma but was unable to find a teaching post. Einstein took a position as a technical assistant in the Swiss Patent Office. By mid-1905, he was awarded his PhD in physics when he had published four seminal papers (they would later be known as the annus mirabilis papers), which established special relativity, the existence of atoms, and the photoelectric effect. It then took until 1915 before he published his General Theory of Relativity. But he did this work on his own. Albert received honorary doctorate degrees in science, medicine, and philosophy from many European and American universities.

The difference between Einstein and economics is rather simple. Physics is a subject-based upon proof. Economics is a social science and has nothing to do with proof. What I have found is that less than 20% of CFOs in major companies have any degree in economics. They say 37% have MBAs, but I have encountered more with degrees in engineering than economics. The degrees these days are becoming worth less and less because they are certifications from institutions and teachers who have no real-world experience.

In truth, rarely do you find someone other than a doctor or lawyer doing what they have a degree in. This is why degrees have become worthless for many companies no longer even require a degree for that has no bearing upon your skill set. I hated economics in school for it made no sense and it was all about manipulating society with competing theories. I enjoyed physics for it was not subject to random theories that sounded nice (i.e. Marx & Keynes).

I find it curious that I ended up in economics ONLY because I was a trader who really specialized in foreign exchange. That specialty caused me to be called in during financial crises because they still do not teach foreign exchange in schools. It is also what brought Milton Friedman to come to listen to me at a Market Technician’s conference in Chicago. Milton explained to me that I was doing only what he had dreamed of back in 1953 of how the world would work under a floating exchange rate system.

When I was 13, my family took me to Europe for the summer. We traveled from Sweden down to Italy. Traveling through all those countries and having to constantly change currencies taught me about the foreign exchange at a very early age. I grew up understanding FOREX, and when 1971 came and the floating exchange rate began, my own experiences came into play. By the time the first bank failures appeared by 1974 due to currency fluctuations, I was asked to help. There were no formal classes in foreign exchange and there still are none today. One had to abandon economic analysis which is domestically focused and adopt an international view.

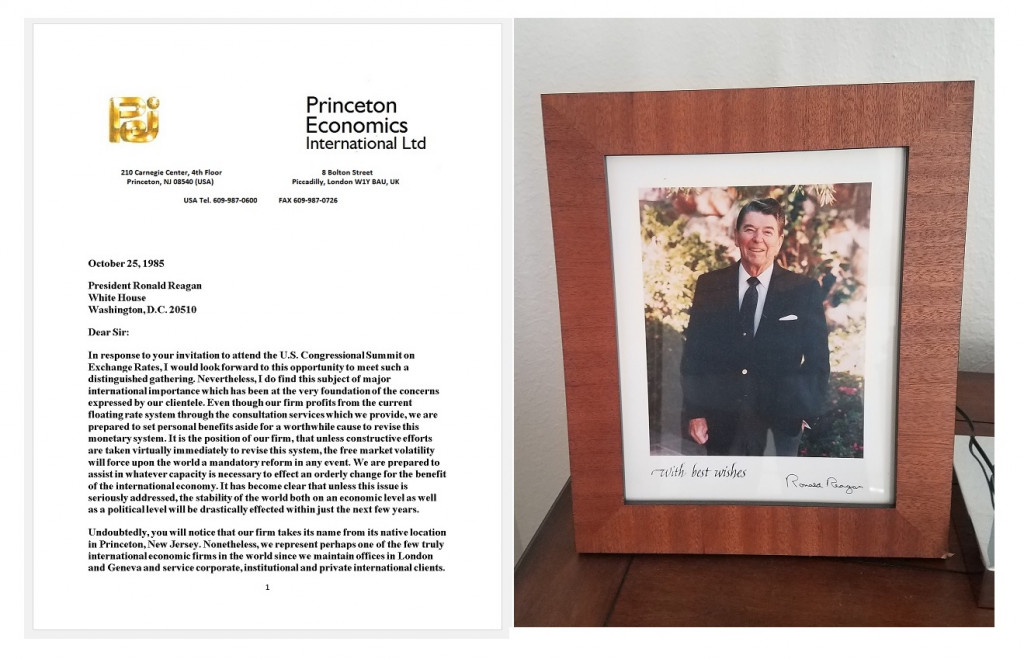

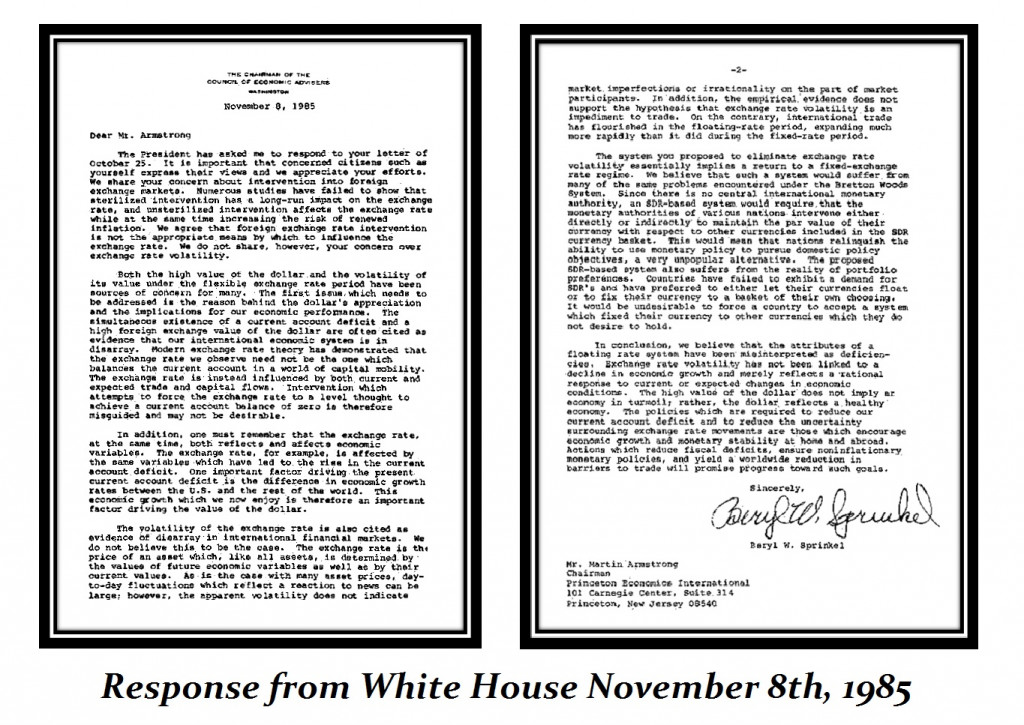

In the summer of 1985, this is when the Plaza Accord took place that created the G5 with the intent to manipulate the dollar lower. I was called in because expertise in foreign exchange was not something you went to school to get a degree in. This was a new subject and they had to turn to people in the real world, not academia.

I warned that such manipulation would lead to a crash in two years. The presidential commission to investigate the 1987 Crash had to call me in.

I was called in to testify about international economics and the impact of taxes and foreign exchange on July 18, 1996.

In May 1997, again, the Treasury under Robert Rubin was back at it and talking the dollar down while engaging in trade disputes. Again, I warned not to do this and again the Treasury had to respond.

My own personal career has been built upon experience. There are no degrees in hedge management any more than there are degrees to be the head of the country, no less run for Congress.

So why do a major percentage of successful businessmen not have degrees? There is no degree that teaches them to be creative. All great innovations are NEVER taught. They come only from those who are CURIOUS and question the status quo. This is why A students indeed work for C students or dropouts, because the A student accepts the status quo and teachers love that. When teachers are questioned and challenged, they typically are hostile and give lower marks to students who do not blindly accept what they say. Thus, it is not always because someone is stupid that they get the C or dropout. They do not accept the status quo. This is where ALL innovation comes from. It does not come from the A student who surrenders to the status quo, but from the dropouts or C students. As Einstein said, it is curiosity which is so essential to innovation.

Hence, degrees have become far less important today than ever before. Despite the fact that Einstein was given a degree, he studied and reasoned on his own. There is a growing list of companies no longer requiring any degree which includes Google, Apple, and the accounting firm Ernst & Young.

Anyone who thinks a degree is necessary to be even a fund manager, good luck on that. It is the track record that matters, not a degree since there are no such degrees in how to be a hedge fund manager. I was never named hedge fund manager of the year in 1998 because of a degree — it was based solely on performance.