Markets oscillate back and forth. I understand that to the people just coming to this blog that this may look like the “Matrix” or having to learn a new language. But keep in mind that it may appear to be difficult at first, but like speaking a different language, somehow it just flows out when you are there. Trying to learn a language without the context of having to use it is next to impossible. When you start to actually think in another language, you’ve nailed it. Trading is the same thing. It comes and the light goes on. I was in a hotel in Paris and an elderly Japanese couple were trying to check in and they had nobody to help them. I stepped in and Japanese just flowed naturally.

The key to approaching a new subject matter is not to start at the top; instead reduce it to its seed. When I began engineering school, about 80% of the class dropped out because the teacher was horrible. I too was considering giving up. He wrongly started at the top and said we would have to know every aspect of that mainframe before we could graduate. I had reams of notes and they made no sense. Then finally, after we lost most of the class, he put on the board an “and/or circuit,” which is the simplest invention. A gigabyte is the number of magnets that can be charged plus or minus to store a number expressed in binary. Had that professor started with this base circuit upon which a computer was created (and/or circuit), we would not have lost 80% of the class.

Here too, the most basic thing to start with is the natural ebb and flow of everything within the economy. Absolutely every decline in a free market is followed by a bounce, and every rally is followed by a decline. Understand that this the basic motion that drives everything. We personally have our good days and our bad. There is a cycle to everything right down to the way we feel. The Romans had their goddess Fortuna (Fortune) who had a cornucopia in one arm (symbol of plenty) and the other hand was on the rudder of a ship, suggesting she could change your fortune at any moment; a cycle of luck.

Here too, the most basic thing to start with is the natural ebb and flow of everything within the economy. Absolutely every decline in a free market is followed by a bounce, and every rally is followed by a decline. Understand that this the basic motion that drives everything. We personally have our good days and our bad. There is a cycle to everything right down to the way we feel. The Romans had their goddess Fortuna (Fortune) who had a cornucopia in one arm (symbol of plenty) and the other hand was on the rudder of a ship, suggesting she could change your fortune at any moment; a cycle of luck.

Nothing lasts forever; absolutely nothing. Start with the reality that every decline has a bounce and every rally has its correction, and you will not buy the high or sell the low because you will not allow your emotions to make those decisions. The vast majority gets trapped because they expect whatever trend is in motion to stay in motion, which is a huge mistake.

Your greatest opponent in trading is your own emotions. Reduce your trading and your stress will reduce and your profits will rise. Once you grasp that there is a rhythm to the rise and fall of markets, you will shed that novice expectation that the trend will never change. Going with the flow is living with the cycle.

We have to understand the inherent tendency that causes people to generally be followers. We gain CONFIDENCE when everyone is doing the same thing, and we often see the madness and delusions of crowds. This is perhaps our hardwired instinct that is difficult to overcome. You have to almost become passionless. Some would say I had ice water for blood. It was hard to move me for I would just look at the numbers and never get attached to a trade. We can see from this illustration that the Weekly Bullish Reversal in the Dow was 17750, despite the fact we were down at 15500. This gap shows just how far you can move without changing trend. We show this in our reports as risk management, which gives the percentage up and down from the current level. That is based upon the reversals and not some standard formula of a percentage moving equally on both sides. So I have learned to not be too impressed until key points are elected. It is very black and white.

To avoid getting slaughtered, try to “feel” the market. Every decline is followed by a rally, just as every rally is followed by a decline. Nobody can alter the long-term trend. There are no all-powerful market manipulators. The central banks try like hell, but look, with everything Draghi has done, he still constantly has to do more. He cannot win because the economy is far bigger than any manipulator, be it government or the NY bankers. You can lose something with the trend, but you cannot change a bull market into a bear market or force the economy out of deflation with quantitative easing. Only a fool would believe such nonsense.

To avoid getting slaughtered, try to “feel” the market. Every decline is followed by a rally, just as every rally is followed by a decline. Nobody can alter the long-term trend. There are no all-powerful market manipulators. The central banks try like hell, but look, with everything Draghi has done, he still constantly has to do more. He cannot win because the economy is far bigger than any manipulator, be it government or the NY bankers. You can lose something with the trend, but you cannot change a bull market into a bear market or force the economy out of deflation with quantitative easing. Only a fool would believe such nonsense.

Do not listen to excuses why analysts are wrong. The market is the only thing that is infallible. If I am wrong, hey, it’s my opinion. I failed to check something. Only I am to blame. The markets speak to us. It is a challenge to learn how to listen and never pontificate to the market. They will just laugh back.

The numbers we provide are really good. For year-end 2015, gold held 1045, oil $35, the euro held 10365, and the Dow closed lower than 2014. The market was speaking to us for it is always the whole. If you focus on a single market, you will never understand how things function. It does not matter if one market has done what you did not expect. You were wrong in your expectation; not the market.

Each of these main markets (gold, crude, euro, Dow) warned the first quarter would provide a counter-trend move. Each failed completely to close below the numbers we gave and that means WHAT WILL NOT GO DOWN GOES UP. This was not personal opinion. If you are going to constantly try to personalize something, you cannot advance. Absolutely no individual can possibly be correct from an opinion perspective. You should NEVER trade or invest because someone said they thought this or that would unfold. There are no demigods of finance.

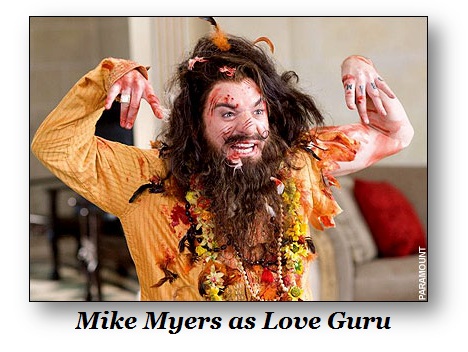

There is a beat to this whole thing we call the economy. If you are still going to wallow in a single market perspective and soak up the fundamental nonsense, then good luck in life. Enjoy what you have now, for you will not have much left in a few years. You have come to the wrong blog if that is your expectation. This is a place to learn and expand your mind, not to look for some guru. If your eyes are opening, there is a whole new world to explore just waiting to be discovered. Welcome to how everything really functions. It is a pendulum that swings back and forth between bulls and bears. Life is a learning experience. Enjoy it. Knowledge is the most expensive thing we have because it takes mistakes to acquire it.

There is a beat to this whole thing we call the economy. If you are still going to wallow in a single market perspective and soak up the fundamental nonsense, then good luck in life. Enjoy what you have now, for you will not have much left in a few years. You have come to the wrong blog if that is your expectation. This is a place to learn and expand your mind, not to look for some guru. If your eyes are opening, there is a whole new world to explore just waiting to be discovered. Welcome to how everything really functions. It is a pendulum that swings back and forth between bulls and bears. Life is a learning experience. Enjoy it. Knowledge is the most expensive thing we have because it takes mistakes to acquire it.