QUESTION: Martin,

I’m curious to your comment “The greatest danger to America will be a strong dollar”. Why is that? I’m trying to take a global view of this statement but I can’t wrap my head around it. It would seem that those in the United States would benefit greatly from a stronger US dollar as the rest of the world gets weaker and weaker.

Heck, cars will be cheaper. Electronics would be cheaper. That vacation to Europe that I have been putting off for years would become cheaper as well. Where is the danger?

MM

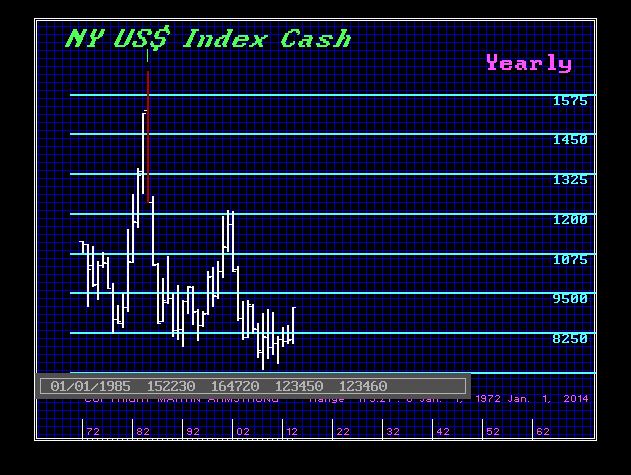

ANSWER: The more a currency rises, the less competitive its corporations become both globally in world trade as well as domestically against imports, which typically results in rising unemployment. During the 1930s, the dollar soared and Europe collapsed during the 1931 Sovereign Debt Crisis. That trend of capital inflow to the USA set in motion the age of Protectionism. Politicians then blocked imports or impose tariffs in an attempt to stop the contraction in domestically due to the rising dollar. The dollar traditionally advances during an economic recession. It was the strong dollar in 1985 which led to the birth of G5 (now G20) to force the dollar down rather than use protectionism. Yet the USA still prohibited foreign investment in real estate (just reversed in December 2015).

Therefore, a strong dollar will not merely send commodities lower, but it will help to turn the U.S. economic growth down sharply. The dollar bottomed in 1978 and it peaked with the deflation in 1985. This next peak will once again result in some reform to the monetary system. We saw protectionism in 1932 and the G5 in 1985. We will see the monetary system revised only with another dollar rally.