Despite the fact that the rally in Shanghai was by no means a real bull market, regardless of the percentage move back up, keep in mind that what goes up big also goes down in a hurry. This market can make new lows in today’s session, taking a hint from the USA and Europe.

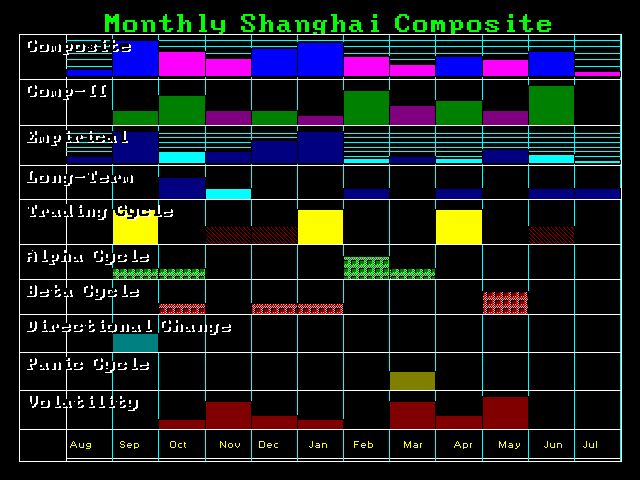

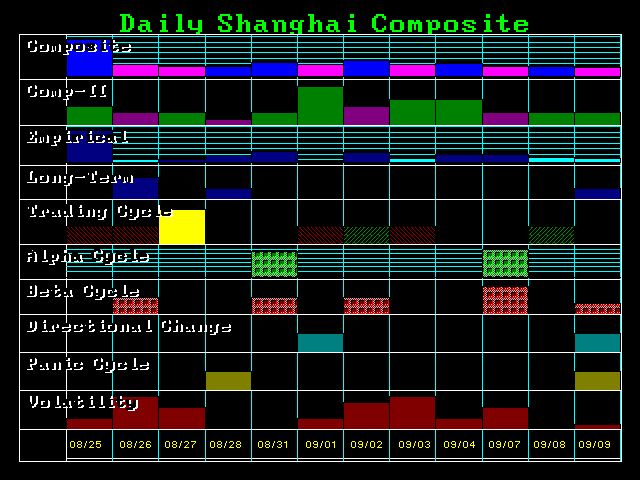

Our timing models point to today with volatility remaining high for the balance of the week. This should keep Western markets on their toes, albeit they are not in the same technical position.

The critical support lies at 3049100 and a monthly closing beneath that warns that we should see a sharp drop test back at the 1980000 area. Support lies at the Weekly Bearish Reversals to be found at 3195880 and 3126900. A breach of this area warns of an eventually drop back to 1984800. A monthly closing beneath that level will confirm a revisit of the old lows lies ahead.

Here we fully expect that the low on this correction may not be seen until September. This would certain keep Western market on the edge.