QUESTION: Hi Martin,

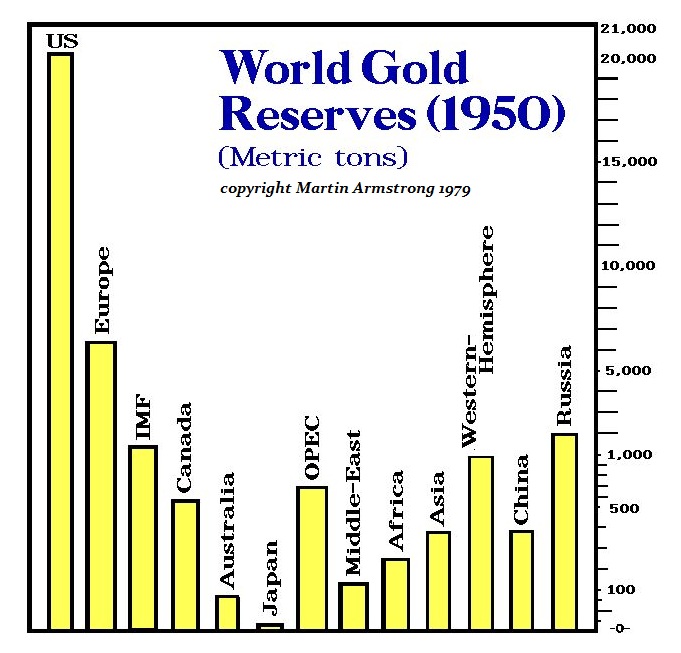

ANSWER: The gold promoters’ fundamental explanation has done a tremendous amount of damage. They have wrongly linked gold to geopolitical events as if it were somehow always bullish regardless of where the event takes place. Capital always flees from the battlefield. During WWI and WWII, money fled to the USA, and at the end of the day, the USA had the greatest gold reserves. Capital fled the USA during the Cuban Middle Crisis. It is not as plain as vanilla as these people report.Furthermore, we are in a Sovereign Debt Crisis that began in Europe, but will spread to Japan before it reaches the USA probably in 2017-2018. The euro fell and the Dow rose. This is showing net capital movement out of Europe to the USA in the wake of the siege of Paris.

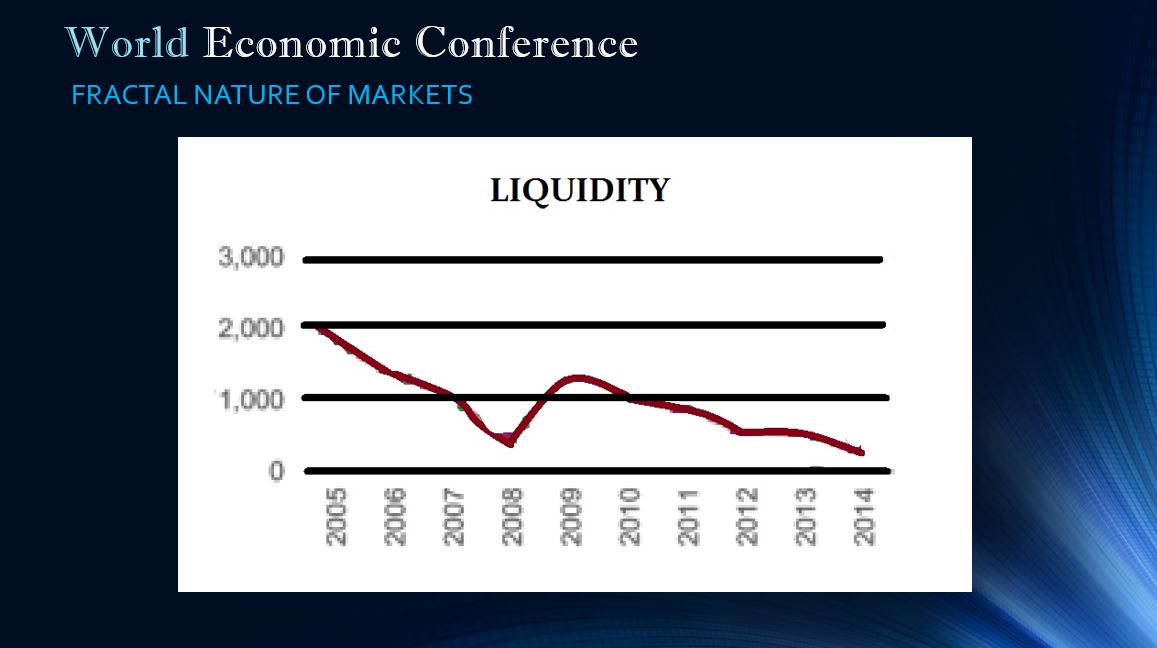

Try not to look at everything through the eyes of only gold. You may discover that there is a time to buy, and a time to sell.There is something interesting going on in the world of fixed income, even in the debt markets. Throughout the global markets, there is a clear trend emerging as we have warned. The traditional relationship between government and private debt is inverting as part of the Sovereign Debt Crisis. Within the USA, we are seeing capital shifting toward good quality corporate debt. This is confirming the forecast we have been making.